>

> >

> >

>

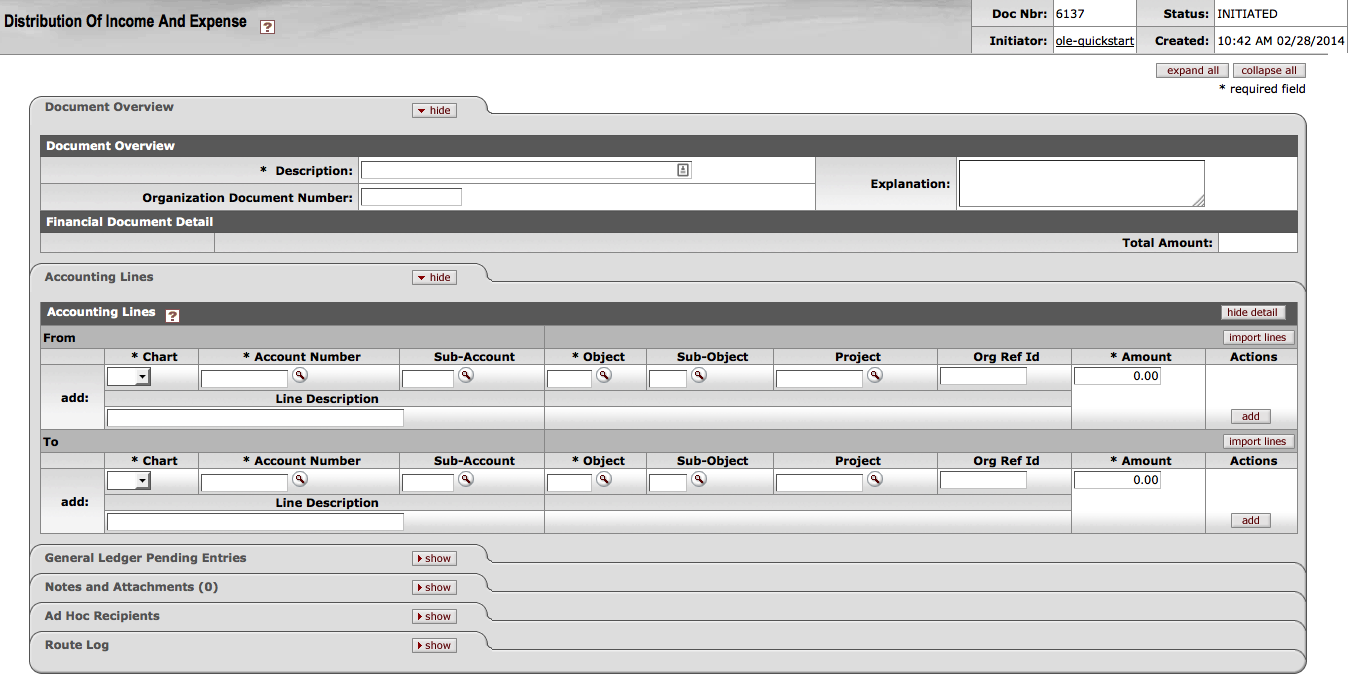

Use the DI document to distribute the income or expense assets and liabilities from a holding account to one or more appropriate account(s) when one account has incurred expenses or received income on behalf of one or more other accounts. It can also be used to move income, expenses, assets and liabilities to other sub-accounts, object codes, or sub-object codes. Fiscal officers and support staff, department, responsibility center, and campus administration staff are typical users of the DI documents.

Note

Distribution of Income and Expense continues to be reviewed for OLE use.

The DI document has only the standard financial transaction document tabs and does not have any unique tabs of its own.

Note

For more information about the standard tabs, see Standard Tabs on the Guide to OLE Basic Functionality and Key Concepts.

|

Note

The Year-End Distribution of Income (YEDI) document is available only during the fiscal year-end close.

Debits must equal credits.

OLE automatically generates cash object code offset entries as defined by the information entered into the document

The following object sub-types are prohibited in the DI document:

Restricted object sub type in the Distribution of Income and Expenses document

|

Sub-Type |

Description |

Restrictions |

|

LD |

Loss of Disposal of Assets |

Use CAMS Documents |

|

OP |

Other Provisions |

Use Auxiliary Voucher (AV) document |

|

MT |

Mandatory Transfers |

Use Transfer of Funds (TF) document. |

|

TF |

Transfer of Funds |

Use Transfer of Funds (TF) document. |

|

TN |

Transfer - Generic |

Use Transfer of Funds (TF) document. |

|

BU |

Budget Only Object Codes |

Use Budget Adjustments (BA) document. |

|

CA |

Cash |

Use Journal Voucher (JV) document |

|

FB |

Fund Balance |

Use Journal Voucher (JV) document. |

Fiscal Officers for all From and To accounts must approve the DI document. Additional approvals may be established within the institution's review hierarchy or designated through Ad Hoc routing. The document status becomes 'FINAL' when the required approvals are obtained and the transaction is posted to the G/L during the next G/L batch process.

Select Distribution of Income and Expense from the Others submenu.

A blank DI document with a new Document ID appears

Complete the standard tabs.

In the Accounting Lines tab, transactions are entered in the From and To sections. Entries in the From section are reductions to the account and entries in the To section are increases to the account. Expense object codes in the From section are credited while income object codes are debited. In the To section, the opposite is true.

Note

For information about the standard tabs such as Document Overview, Notes and Attachments, Ad Hoc Recipients, Route Log, and Accounting Linestabs, see Standard Tabs on the Guide to OLE Basic Functionality and Key Concepts.

Click

.

.Review the General Ledger Pending Entries tab

The pending entries include the offset generated lines to cash or fund balance object codes.

Appropriate fiscal officers and organization reviewers approve the document.

Note

For information about the Route Log tab, see Route Log on the Guide to OLE Basic Functionality and Key Concepts.

For more information about how to approve a document, see Workflow Action Buttons.