>

> >

> >

>

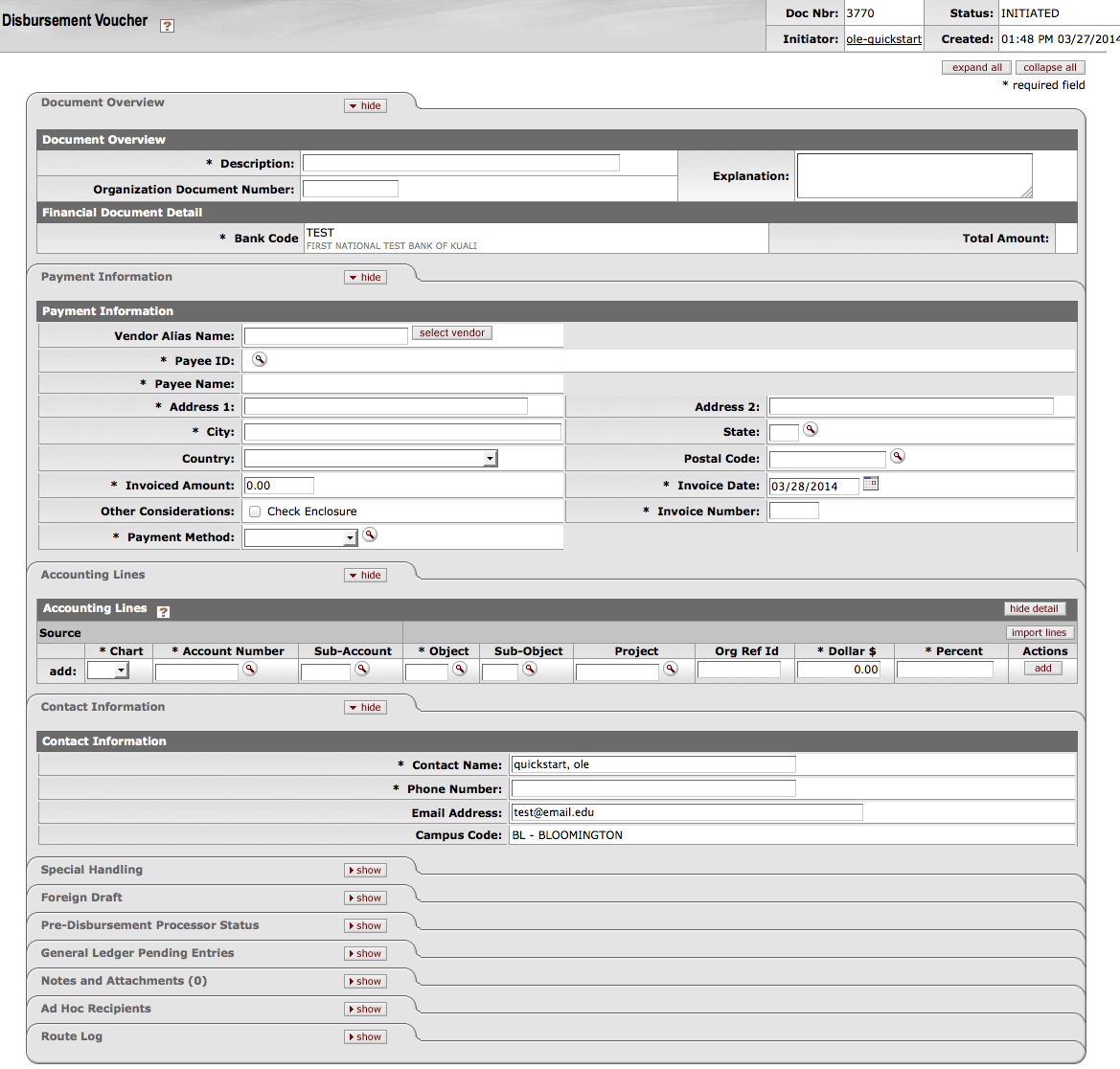

The Disbursement Voucher (DV) document is used to issue payments to vendors using clearing/deposit accounts. The DV is used for recording the Advance Deposits or Prepayments to vendors, when titles or POs are unknown.

Making Prepay/Deposit Account arrangements work is a multi-step process and involves more than just the use of the Disbursement Voucher:

A unique account(s) must be created for the initial payment.

The initial payment is made via a Disbursement Voucher.

As the actual material is received, requisitions and POs are created using regular accounts and object codes.

Invoices are created with payment method type “deposit”.

Regular accounting lines are completed. Due to the payment method type “deposit” an additional accounting line is available to allow for special accounting to occur.

In the additional accounting line (off-setting account), the user lists the original account and object code used on the DV ( the one created in step 1 and used in step 2). Instead of OLE creating the normal (behind the screens) accounting offset, the user manually defines what to use. Via this manual entry the deposit account(s) is reduced by the amount of the invoice being created. As this process continues eventually the deposit account(s) will have a zero or negative balance, or the predefined deposit account period ends. The balance in the deposit account(s) is the amount to be settled with the vendor.

A person is assigned the role to monitor, approve and control deposit account activity.

The DV document has several unique tabs—Payment Information, Accounting Lines, Contact Information, Special Handling, Foreign Draft, and Pre-Disbursement Processor Status—in addition to the standard financial transaction tabs.

Note

For more information about the standard tabs, see Standard Tabs on the Guide to OLE Basic Functionality and Key Concepts.

|

In addition to the Document Overview and Accounting Lines tabs, Payment Information is always required.

The Payment Information tab contains information regarding the payee, invoice information and payment method.

The Payment Information tab contains important information such as the vendor lookup, invoiced amount, invoice date, invoice number, payment method, and check enclosure. This section must be completed for every DV document.

|

Payment Information tab definition

|

Title |

Description |

|

Vendor Alias Name |

If you know the vendor's alias, enter

the code in the box and click |

|

Payee ID |

Required. Retrieve the payee ID from

the Payee Lookup |

|

Payee Name |

Display-only. After you select the

payee ID from the Payee

lookup |

|

Address 1 |

Required. The first line of address to which the check should be mailed. The system fills in this information automatically but you may change it. |

|

Address 2 |

Optional. Enter the second line of the address to which the check should be mailed. |

|

City |

Required. Enter the city to which the check should be mailed. |

|

State |

Required for US. Enter the state to which the check should be mailed. |

|

Country |

Optional. Select the payee's country from the Country list. |

|

Postal Code |

Required for US. Enter the postal code to which the check should be mailed. |

|

Invoiced Amount |

Required. Enter the total amount due from the vendor's invoice. |

|

Invoice Date |

Required. Enter the invoice date from

the vendor's invoice. The date can also be selected from

the calendar |

|

Other Consideration |

Optional. Check Enclosure: Refers to any documents related to the DV document that must accompany the check when it is mailed to the payee. Selecting the check box properly indicates that there is a form or other attachment that must accompany the check. |

|

Invoice Number |

Enter the invoice number from the vendor's invoice |

|

Payment Method |

Required. Select the method in which the payment should be made from the Payment Method list. Deposit: This selection indicates the payment is for a Deposit Account. (This should not be used for DV documents. It should only be used on Invoice Type Documents.) Check: This selection indicates a paper check in US dollars is to be issued. Credit Card: This selection indicates the payment is to be charged to a procurement card. Foreign Draft: This selection indicates that the payment is to be made in a foreign currency. Wire Transfer: This selection indicates you wish to have the disbursement wired to the recipient. |

The payee ID is required on the Payment Information tab. This identifies the person or business the disbursement is paid to. Payees must exist in the system in order to be selected on the disbursement voucher. OLE uses the Vendor table and the Customer Profiles setup in Pre-Disbursement Processor module for reference. If the payee already exists in the system, you can identify it by searching for it by using the Payee lookup.

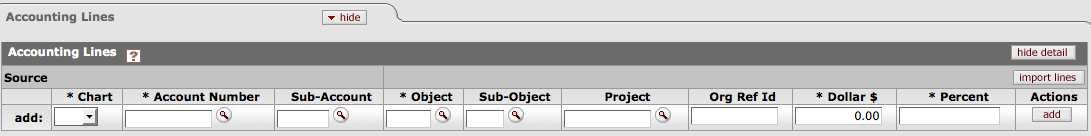

The Accounting Lines tab contains the accounting information.

|

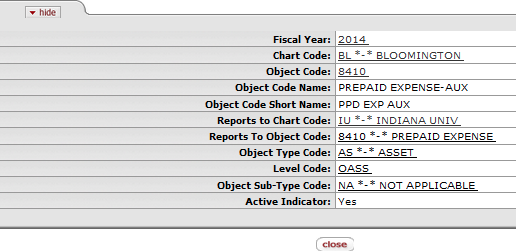

Add the applicable Chart, the special account set up for this payment, object

code is always 8410 (or your local prepaid expense). Enter the dollar amount of

the deposit payment from the vendor's invoice and click  .

.

Note

For more information about the filling in accounting lines, see OLE Financial Documents Accounting Lines Tab on the Guide to OLE Basic Functionality and Key Concepts.

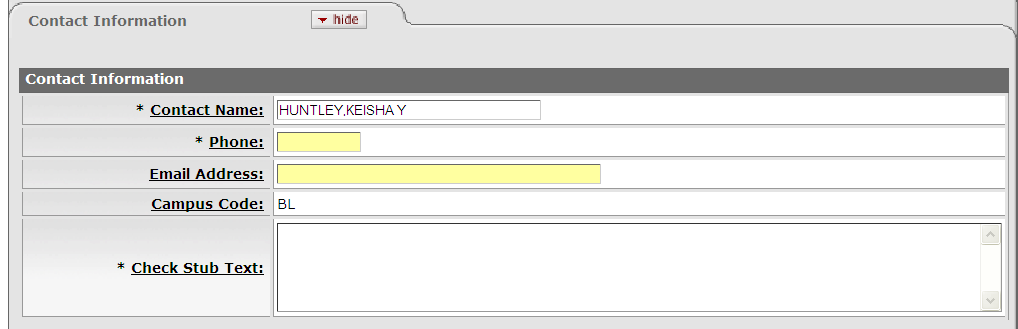

The Contact Information tab is an optional tab that contains information only. When the DV document is first initiated, the Contact Name and the Campus Code default to those of the initiator's.

|

The Contact for a DV is typically the initiator, thus the contact information is typically the name, phone, and email address of the initiator.

Contact Information tab definition

|

Title |

Description |

|

Contact Name |

Required. This field is pre-filled with the name of the document initiator but may be edited. |

|

Phone |

Required. Enter the contact person's phone number (including area code) |

|

Email Address |

Required. Enter the contact person's email address |

|

Campus Code |

Display-only. The code of the campus associated with the document's initiator, derived from the user's profile. |

Note

If you want to include information that only other OLE users can view, add a note or attachment to the document. For more information about the Notes and Attachments tab, see Notes and Attachments Tab on the Guide to OLE Basic Functionality and Key Concepts.

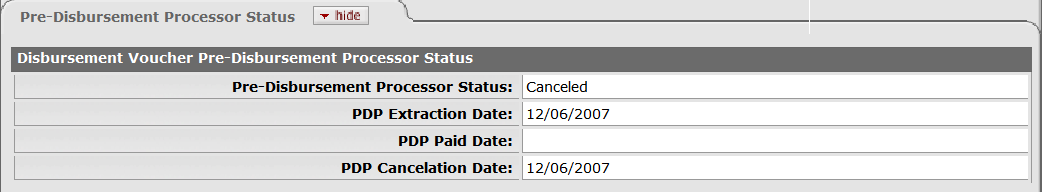

The Pre-Disbursement Processor Status tab displays information from the Pre-Disbursement Processor (PDP) so you can track the payment status and the status date.

|

Pre-Disbursement Processor Status tab definition

|

Title |

Description |

|

Pre-Disbursement Processor Status |

Display-only. Displays the payment processing status from the Pre-Disbursement Processor (PDP). |

|

PDP Extract Date |

Display-only. The date when the disbursement voucher was extracted for payment processing by the PDP. |

|

PDP Paid Date |

Display-only. The date when the payment was disbursed by PDP. |

|

PDP Cancellation Date |

Display-only. The date when the payment was canceled within PDP. |

DV Payee cannot be the same as the initiator.

DV Payee must be active.

Check amount cannot be negative.

There must be at least one accounting line.

Account lines total must not be negative. Total of accounting lines must match the vendor invoiced amount.

DVs with Account-Funds designated as Clearing/Deposit or other Payment method to denote deposit, must be routed for approval- no automatic approvals.

Only a Disbursement Voucher may use Accounts of “Fund Group, Sub-Fund Group” – Clearing or Deposit. These forms of accounts will be restricted for use with prepayments. REQ, PO (versions), INV are prohibited from using this Account Type.

The DV document must route through a series of approvals before the disbursement is actually made based on the rules set up by the institution. Due to its unique nature, the DV document has some special routing issues which are explained below:

The DV document first routes to the fiscal officer for each account in the Accounting Lines tab.

After it has been approved by all required fiscal officers, the document routes, as specified by the institution's rule, to the organization review routing level.

After the document has been approved by all organizational approvers, the DV document goes through any special routing as required by business rules surrounding the attributes of the transaction and the payee.

The document status becomes 'FINAL' when the required approvals are obtained and the transaction is processed by the institution defined process, which might include the Pre-Disbursement Processor.

DV routing

|

Condition |

Special Routing |

|

Initiator's Campus |

Final approval by members of OLE-FP Disbursement Manager role for the appropriate campus. Campus is based on the campus associated with the initiator's OLE-SYS User role |

Before creating the DV

Create a unique Account with a sub-fund group code of CLRREV and assign the vendor to the account in “Vendor for Deposit Account”. The account does not need to be set up with a fund/budget before it can be used on the DV. The DV will create the fund balance.

Note

The account does not need to be set up with a fund/budget before it can be used on the DV. The DV will create the fund balance.

Object Code 8410-prepaid expense will need to be set up if there isn’t one:

Cache will need to be cleared:

Login as Admin.

Go to Admin Tab > Monitoring > Service Bus > Cache Admin

Click Cache Admin

Check:

coreServiceDistributedCacheManager

kewDistributedCacheManager

kimDistributedCacheManager

krmsDistributed Cache Manager (DO NOT SELECT)

locationDistributedCacheManager

ole.core.DistributedCacheManager

Click Flush and close Cache Admin.

Sign back in as normal user.

Prepare a DV

On the Select/Acquiretab, under Other, select Disbursement Voucher.

A blank Disbursement Voucher document with a new document ID appears.

Complete the Payment Information tab.

Complete the Accounting Lines tab.

Enter the chart code for the account set up in Step 1 above. Enter the Account and use Object code 8410 - prepaid expense. Click the ADD button.

Complete the remaining tabs as required.

Click

.

.Appropriate fiscal officers and organization reviewers approve the document.

Note

For more information about how to approve a document, see Workflow Action Buttons on the Guide to OLE Basic Functionality and Key Concepts.

The deposit account will now have a ‘fund’ showing the amount of the deposit payment.

Prepare Requisitions and Invoices

As the material is received create requisitions and invoices in OLE. When creating invoices use payment method “deposit”. After adding the PO, click the details button on the current items tab. An additional accounting line will be available.

Enter chart code, the deposit account, object code 8410 and add the amount matching the regular accounting line.

As invoices are processed the amount in the deposit fund will decrease. The approver will need to monitor the fund balances to resolves variances and settle the account(s) as all deposit account funds are exhausted or the deposit period ends, whichever is defined as the end by the terms of the deposit agreement.