>

> >

> >

>

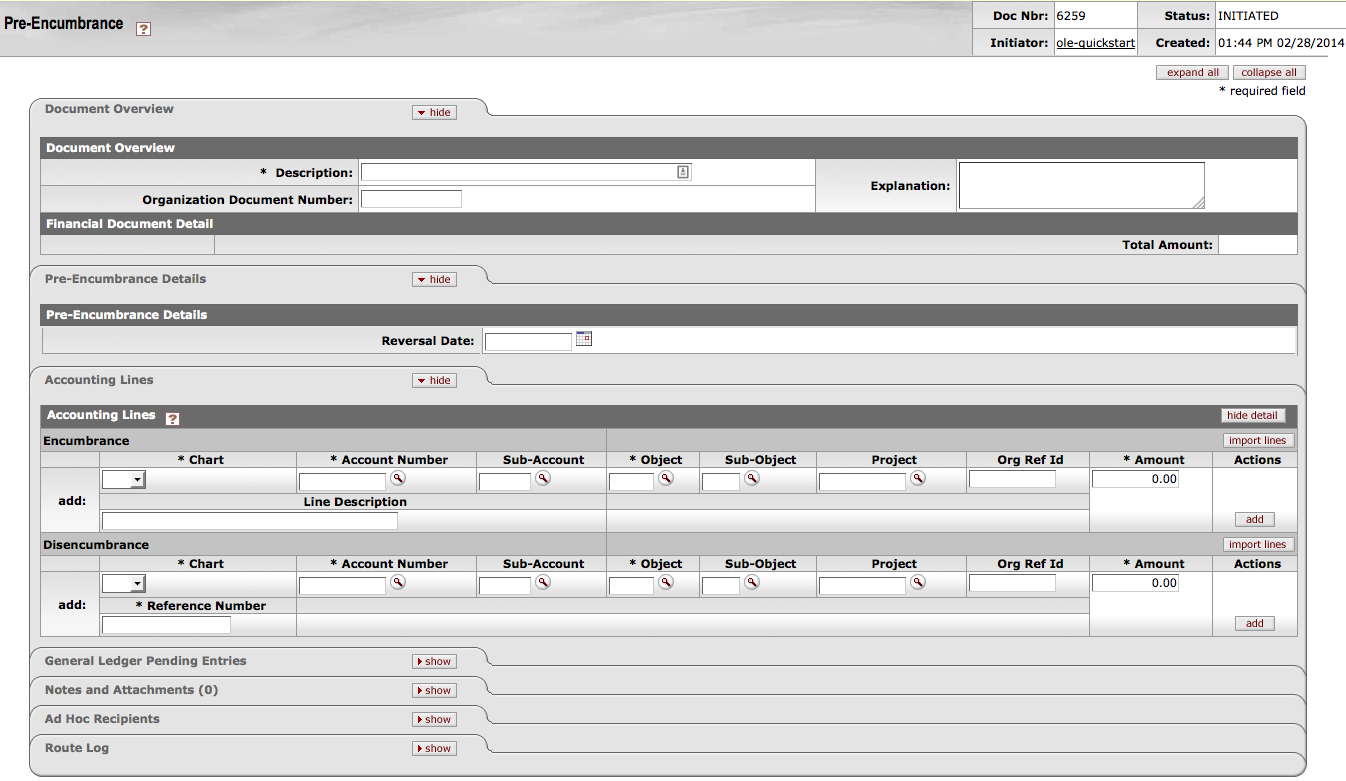

The Pre-Encumbrance (PE) document may be used in OLE as a “Reserve Option” on a single or group of accounting lines- Account/Objects. An Account could be setup at the beginning of the year, with a Budget allocated to the Account-Object code. Either through Restricted Status or Sufficient Fund check options, or the use of the Pre-Encumbrance, an account could be temporarily restricted, allow spending up to a $/% limit, or be “pre-encumbered” without requiring a Purchase Order or Payment Request.

The Pre-Encumbrance (PE) document allows you to add encumbrances using an e-doc instead of relying on information from some system outside OLE. These transactions are for the use of the fiscal officers to earmark funds for which unofficial commitments have already been made, setting aside amounts for future anticipated expenses that might not otherwise be encumbered. The document can also be used to disencumber open encumbrances created with the PE document.

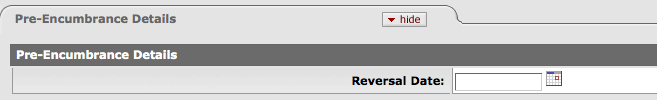

A PE document has its own unique tab called Pre-Encumbrance Details in addition to the standard financial transaction tabs.

Note

For more information about the standard tabs, see Standard Tabs on the Guide to OLE Basic Functionality and Key Concepts.

|

The Pre-Encumbrance Details tab contains an optional Reversal Date field date. When entering an encumbrance, a reversal date may be entered to indicate when the system should automatically reverse the encumbrance. This date must not be earlier than the current date.

Encumbrances entered on a PE document without a reversal date must be reversed manually by processing another PE document and entering one or more accounting lines in the Disencumbrance section of the document.

|

Title |

Description |

|

Reversal Date |

Optional. Enter the date when the system should automatically reverse the encumbrance. The date must not be earlier than the current date. |

There must be at least one accounting line in the document.

Unlike other documents with more than one side, there is no relationship between the Encumbrance and Disencumbrance sections of accounting lines. Hence, there are no totals in the Accounting Lines tab of the document.

Only object codes with an object type code of Expenditure Not Expense (EE) or Expense Expenditure (EX) are allowed on this document.

Negative amounts are not allowed. Encumbrances and disencumbrances are both recorded as positive amounts.

OLE automatically generates offset entries, as defined by information entered into the document.

Tip

If you are using the Sufficient Funds checking feature of OLE, remember that encumbrances are taken into account in the sufficient funds calculation.

The PE document routes based on the account numbers used on the document as follows:

The fiscal officer for each account must approve.

Organization review routing occurs for the organization that owns each account.

Sub-fund routing occurs based on the sub-fund of each account.

The document status becomes 'FINAL' when the required approvals are obtained and the transaction is posted to the G/L during the next G/L batch process.

Select Pre-Encumbrance from the Others submenu on the Select/Acquire tab.

A blank PE document with a new document ID appears.

Complete the standard tabs. Complete the Accounting Lines tab as follows:

Complete the Accounting Lines tab by entering information into the Encumbrance section, Disencumbrance section, or both.

Encumbrance Section: Accounting lines entered on the Encumbrance side of the document generate new encumbrances on the specified accounts.

Disencumbrance Section: Accounting lines entered on the Disencumbrance section of the document reverse existing encumbrances on the specified accounts.

Lines on the Disencumbrance section require a Ref Number which identifies the document number of the previous pre-encumbrance that needs to be removed. Disencumbrances entered in the PE document would only be used to remove an encumbrance previously established with a PE document.

Note

For information about the standard tabs such as Document Overview, Notes and Attachments, Ad Hoc Recipients, Route Log, and Accounting Linestabs, see Standard Tabs on the Guide to OLE Basic Functionality and Key Concepts.

Complete the Pre-Encumbrance Details tab.

Click

.

.Review the General Ledger Pending Entries tab.

The pending entries include offset generation lines to a pre-defined reserve for Encumbrances object code.

Review the Route Log tab.

Note

For information about the Route Log tab, see Route Log on the Guide to OLE Basic Functionality and Key Concepts.

For more information about how to approve a document, see Workflow Action Buttons.