>

>  >

>  >

> >

> >

>

The Account document is used to create new accounts or to edit or copy existing accounts. An account is used to identify a pool of funds assigned to a specific university organizational entity for a specific purpose. Accounts are the fundamental building blocks of OLE Financial Transactions. Financial Transactions are always associated with one or more accounts. Accounts and Objects are assigned budgets, and provide the financial framework for budgeting, balance inquiries, and encumbering funds for Purchase Orders, or paying vendors via Payment Requests.

An account has many different attributes associated with it that often determine how OLE allows you to use that account in transactions. It also has attributes associated with it that aid in reporting or drive special processes, such as indirect cost calculation.

The Account document comes with a global document option where you may make certain changes to a group of accounts at once. . Key attributes for OLE Accounts are: Stewardship Requirement, Legacy Fund Code, Fund Group & Sub-Fund group. Each can be used in the future for queries, extracts and reporting as additional “sorts”. The feature of the Account Global document is explained in the section following the Account document.

The Account document has six account specific tabs: Account Maintenance, Account Responsibility, Guidelines and Purpose, Account Description, Stewardship Requirements, and Legacy Fund Codes tabs which group related attributes together.

|

The fields on this tab define the various account attributes which are used in the application of business rules for transactions using the account, reporting options, approval routing, etc.

|

Account Maintenance tab definition

|

Title |

Description |

|

Chart Code |

Required. Enter the code or search for

it from the Chart lookup NoteThough each Account is associated with one Chart, you can allow your accounts to be used by multiple charts, by setting the system's ACCOUNTS_CAN_CROSS_CHARTS_IND parameter to Y. |

|

Account Number |

Required. Enter the unique number to identify a pool of funds assigned to a specific institution entity for a specific function. NoteYou may restrict the account prefix by the use of the PREFIXES parameter. For example, you may configure the parameter to reject account numbers beginning with '3' or with '00. |

|

Account Name |

Required. Enter the familiar title of a specific account |

|

Organization Code |

Required. Enter the number for the

owner of the account, or search for it from the Organization llookup |

|

Campus Code |

Required. Select the physical campus on

which the account is located from the Campus list, or search for it from the

lookup Represents the physical location of the account. |

|

Account Effective Date |

Required. Enter the date when the account became effective. NoteAn account may be used on financial transactions before its effective date. |

|

Account Expiration Date |

Optional. Enter the date when the account expires. Business rules on transactions may prevent the use of expired accounts, or provide warnings when an expired account is being used. Must be equal to or greater than the current date and cannot be before the Account Effective Date. If it is not blank, the continuation Chart of Accounts code and continuation account number are required. |

|

Account Postal Code |

Required. Enter the postal code

assigned by the US Postal Service for the city where the

account is managed, or search for it from the Postal Code lookup |

|

Account City Name |

Required. Enter the city where the account is managed. |

|

Account State Code |

Required. Enter the code for the state

where the account is managed, or search for it from the

State lookup |

|

Account Street Address |

Required. Enter the street address where the account is managed. |

|

Account Off Campus Indicator |

Optional. Select the check box if the account activities occur off-campus; clear the check box if they do not. |

|

Closed? |

Optional. Select the check box if the account is closed; clear the check box if it is open. Closing an account is more permanent than expiring - no transactions can use a closed account and a closed account can only be re-opened by a system supervisor. |

|

Account Type Code |

Required. Select from the Account Type list or search for

it from the lookup A code that categorizes or groups accounts for reporting purposes. |

|

Sub-Fund Group Code |

Required. Enter the code which relates

an account to a fund, or search for it from the Sub-Fund Group lookup A designation of an account specific to fund accounting. |

|

Vendor for Deposit Account |

Enter the vendor associated with the Deposit

Account, or search for it from the Vendor lookup |

|

University Account # |

University Account Number associated with the Library Account. Ensures financial data is matched correctly to the University Account in the enterprise-wide financial system. |

|

Account Restricted Status Code |

Required. Select the account restricted status code from the Account Restricted Status list. This code indicates whether funds in the account are: T = Temporarily restricted R = Restricted U = Unrestricted Restricted (R) and Temporarily Restricted (T) statuses will prevent staff from using accounts to purchase or pay for library materials. If it is 'T,' then an account restricted status date is required. If the sub-fund associated with the account has a restricted status code, then that number pre-fills the field, in which case it is not editable. If the code on the sub-fund is blank, the Restricted Status Code field on the Account document must be completed. |

|

Account Restricted Status Date |

Optional. Enter the date if the accounts restricted status code above is 'T.' This date signifies when the funds are targeted to become unrestricted. If the Account Restricted Status Code is T (Temporarily Restricted), then this field becomes required and the date signifies when the funds are targeted to become unrestricted. |

|

Endowment Chart of Accounts Code |

Optional. Select the Chart of Account code from the Chart list for the account designated to receive income generated from an endowment account or for the guarantee account for an underwrite for Contracts and Grants accounts. |

|

Endowment Account Number |

Optional. Enter the account designated

to receive income generated from an endowment account or the

guarantee account for an underwrite for Contracts and Grants

accounts, or search for it from the Account lookup |

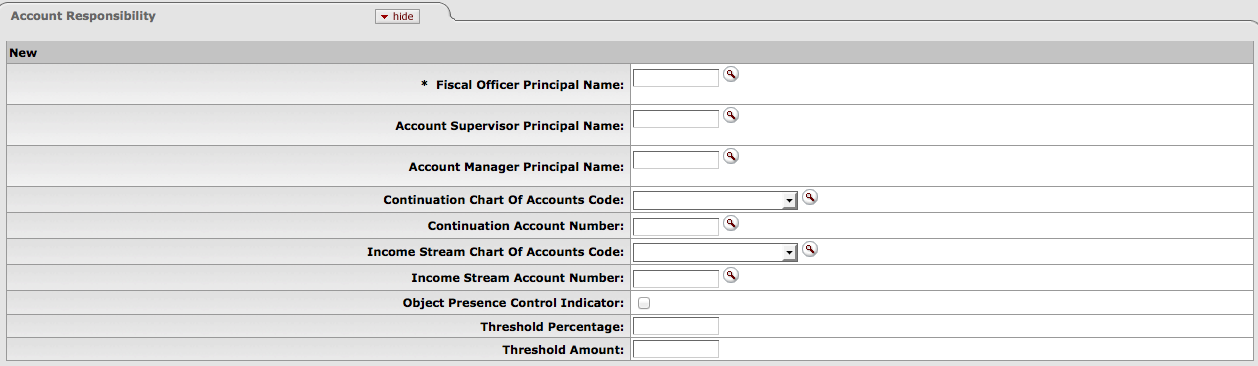

The fields on this tab define the individuals responsible for the account as well as continuation account information and Sufficient Funds parameters.

|

Account Responsibility tab definition

|

Title |

Description |

|

Fiscal Officer Principal Name |

Required. Enter the name of the fiscal

officer, or search for it from the lookup The Fiscal Officer is a person who is trained and hired for the purpose of providing fiscal, policy, and internal control management of all funds in a unit. They are responsible for ensuring that processes and related controls have been established to achieve the mission and objectives of their organization(s). |

|

Account Supervisor Principal Name |

Optional. Enter the name of the account

supervisor, or search for it from the lookup The Account Supervisor will be the leader of the organization in which the account resides. In an academic unit this would probably be the Dean, in an administrative unit it would be the Vice President. |

|

Account Manager Principal Name |

Optional. Enter the name of the account

manager, or search for it from the lookup The Account Manager is the person who through their actions, their position, or the budgeting process of the Dean or Vice President has direct responsibility for how funds are spent and managed. Examples would be a principal investigator who received a grant or contract, an academic person who received internal research funds from the Dean, or a Director of a non-academic department. |

|

Continuation Chart of Accounts Code |

Optional unless the account has an

expiration date, in which case it is required. Enter the

chart code for the continuation account, or search for it

from the Chart lookup |

|

Continuation Account Number |

Optional unless the account has an

expiration date, in which case it is required. Enter the

account that accepts transactions which are being processed

on the account after the account expiration date, or search

for it from the Account

lookup |

|

Income Stream Chart of Accounts Code |

Optional. Select the Chart of Accounts

for the income stream account from the Chart list, or search for it from the

Chart lookup |

|

Income Stream Account Number |

Optional. Enter the account which has

been designated to receive any offset entries from the

account in order to balance responsibility center activity

from the Account list or

search for it from the lookup The account designated to receive general fund income as part of the budget process for institutional funds, or the account designated to receive income from the sponsoring agency on contract and grant funds. When Budget Adjustments that involve accounts with different income stream accounts are made, OLE can be configured to create an automated Transfer of Funds transaction to properly adjust cash between those income stream accounts. |

|

Object Presence Control Indicator |

Optional. Select the check box to indicate that the account uses object presence control. Clear the check box if it does not. Object presence control requires that an object code be budgeted for the account before it can be used on an actual or encumbrance transaction. If checked, requires that an Object Code be budgeted for the account before it can be used on an actual or encumbrance transaction. |

|

Threshold Percentage |

Optional. Enter the percent variance to be used to compare the amount encumbered on the order to the amount invoiced by the vendor. If the difference between these two amounts is greater than the percent entered in this field a warning will appear on the invoice when it is submitted. This warning can be overwritten. |

|

Threshold Amount |

Optional. Enter the amount variance to be used to compare the amount encumbered on the order to the amount invoiced by the vendor. If the difference between these two amounts is greater than the amount entered in this field a warning will appear on the invoice when it is submitted. This warning can be overwritten. |

Tip

Both Threshold Percentage and Threshold Amount can be used if the user wants to see over a certain Threshold Percentage variance but only if it’s over a certain Threshold Amount. (Example: User wants to see anything over a 10% variance, but only if it’s over $100.)

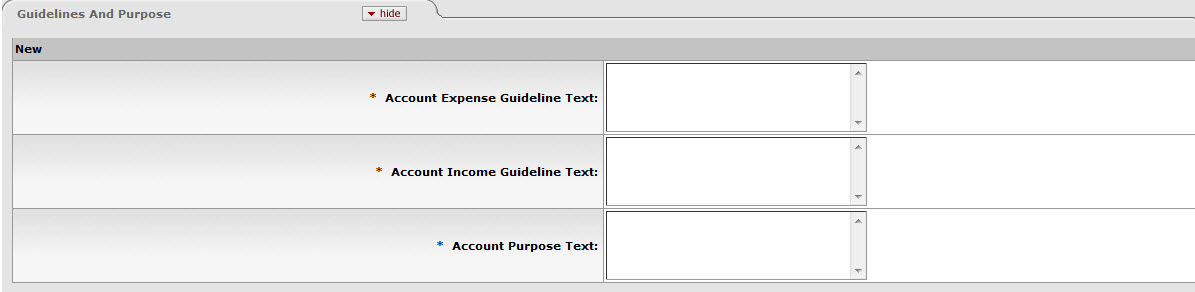

The fields in the Guidelines and Purpose tab collect text description that provide details relating to the type of expenses that should be charged to the account, the source of its income, and the account's overall purpose.

|

Guidelines and Purpose tab definition

|

Title |

Description | |

|

Account Expense Guideline Text |

Required unless the account expiration date is before the current date. Enter the text describing the type of expenditures that take place in the account. It should also explicitly state those expenditures that are not allowed in the account. | |

|

Account Income Guideline Text |

Required unless the account expiration date is before the current date. Enter the text describing the types of income (source of funds) that take place in the account. It should also explicitly state those revenues that are not allowed in the account. | |

|

Account Purpose Text |

Required. Enter the text describing the overall purpose of the account and the function it supports. | |

The Account Description tab contains optional information relating to the physical location of the account.

|

Account Description tab definition

|

Title |

Description |

|

Campus Description |

Optional. Enter additional campus description if desired on the account. |

|

Organization Description |

Optional. Enter additional organization description if desired on the account. |

|

Responsibility Center Description |

Optional. Enter responsibility center description if desired on the account. |

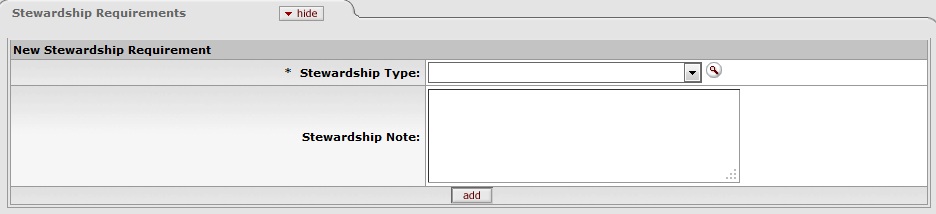

Stewardship Requirements have been added as metadata to be used

in future workflows and routing (think: book plating, donors, etc.) This tab is

repeatable- do not forget to use the  button to commit new Stewardship Requirements to the

Account.

button to commit new Stewardship Requirements to the

Account.

|

Account Stewardship Requirements tab description

|

Title |

Description |

|

Stewardship Type |

Identify the type of stewardship. |

|

Stewardship Note |

Note related to the stewardship requirement. |

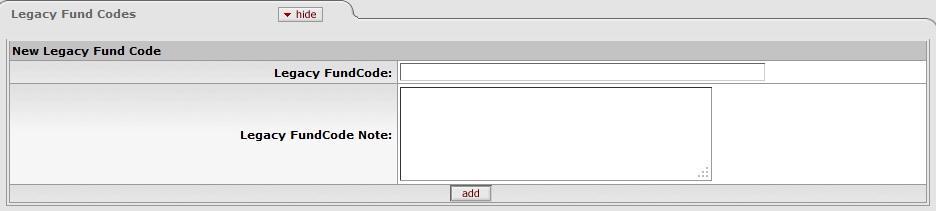

Legacy Fund Codes are added to assist libraries with migrating

from legacy systems and combined fund code strings (which had fiscal year,

account, and object information). This tab is repeatable- do not forget to use

the  button to commit new Legacy Fund Codes to the

Account.

button to commit new Legacy Fund Codes to the

Account.

|

Legacy Fund Codes tab description

|

Title |

Description |

|

Legacy Fund Code |

Uniquely identifies legacy systems’ fund codes |

|

Legacy Fund Code Note |

Note related to the legacy fund code |

Sufficient funds checking is an option that can be used to stop the processing of e-doc transactions when an account does not have a balance large enough to cover expense transactions.

Sufficient funds checking can be established on an account-by-account basis. If the Transaction Process Sufficient Funds Check option on an account is checked and the Account Sufficient Funds Code is set to a value other than 'N' (no checking), then the account is checked for sufficient funds by OLE.

Sufficient Fund Check (SFC) operates differently on encumbrances vs. expenditures:

Encumbrances check against Free Balances (Budget - invoices (liabilities) [pending included] - expenditures [pending included] - encumbrances [pending included], occurs when encumbrances is pending (when requisition created/accts and costs assigned)

Expenditures check against Cash Balance (Budget - expenditures [pending included]) - when Payment Request created (pending).

The sufficientFundsAccountUpdateJob, which can be scheduled or run on demand, evaluates the pending ledger entries to determine whether or not they affect sufficient funds.

Note

For more information about how to run this batch job, see Schedule in the OLE Guide to System Administration Functions. This and other OLE user guides are available for download from OLE Documentation Portal.

|

Sufficient Funds Check tab description

|

Title |

Description |

|

Account Sufficient Funds Code |

Required. Select the code that indicates what level the account is going to be checked for sufficient funds in the transaction processing environment from the Account Sufficient Funds list. The choices are: A = Account C = Consolidation L = Level O = Object Code H = Cash N = No Checking |

|

Transaction Processing Sufficient Funds Check |

Optional. Select the check box if sufficient funds check should be performed on the account. |

|

Encumbrance / Expense Method |

Identifies the type of encumbrance or expense, i.e., "over" or "under". |

|

Encumber / Expense Constraint Type |

Coded selection choice of # (for Amount) or % (for Percentage). |

|

Encumbrance Amount |

Enter a value to be checked when encumbering the account on purchase orders. |

|

Expense Amount |

Enter a value to be checked when paying the account on payment requests. |

|

Notification Type |

When the sufficient fund amount has been reached, you may select what will occur:

|

The Employee Type for the Financial-AQ4, Financial-AQ5, Accounting-AQ4 Fiscal Officer, Account Supervisor, and Account Manager must be 'P (Professional)' and the Employee Status must be 'A (Active).

The following rules apply to closing an account:

You must select an account active indicator: closed.

Account expiration date must be the current date or earlier

A continuation account number must be provided.

Only fully-approved Accounts (like other OLE documents) will display in Account Lookup inquiries or future Available balance inquiries.

The account must meet all the following criteria:

expires on or before the current date

has no budget balance

has no pending ledger entries

has no open encumbrances

has no asset, liability, or fund balances other than the fund balance object code defined for this account's chart and the process of closing income and expense into fund balance must take the fund balance to zero.

Only a system supervisor user can reopen a closed account.

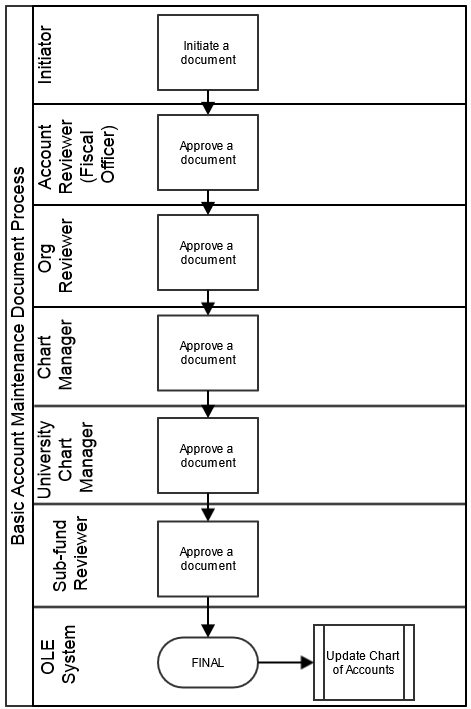

The document routes to the fiscal officer for the account indicated on the document. If the document edits an existing account and includes a change to the value of the Fiscal Officer field, the document routes first to the current fiscal officer and then to the newly designated fiscal officer.

The document routes to the Org Reviewer based on the organization assigned to the account.

The document routes to the Chart Manager based on the chart assigned to the account.

Accounts route to the University Chart Manager for final approval.

As an OLE User, the Account Supervisor receives an FYI copy of the document.