>

>  >

>  >

> >

> >

>

The Sub-Account document is used to define an optional part of the accounting string that allows tracking of financial activity within a particular account at a finer level of detail. Instead of associating budget, actuals and encumbrances with an account, you can specify a sub-account within that account to apply these entries. Sub-accounts are often used to help track expenses when several different activities may be funded by the same account. Sub-accounts can also be related to each other, across accounts, via Financial Reporting codes.

For example, a large organization may have money in a general account that is used by several different areas of that organization. The organization might segregate the budgets for each of the areas into Sub-accounts such as 'Marketing,' 'Research,' and 'Recruitment. When expenses are applied to the account they can be applied to the sub-account level, allowing direct comparisons between the budget and the actual income and expenditures of these smaller categories. Because all of the activity is still within a single account, it is still easy to report on the finances of the overall account.

Sub-accounts take on most of the attributes of the account to which it reports, including Fiscal Officer, account supervisor, fund group, and function code.

Sub-accounts allow you to take advantage of the Financial Reporting Code. This is an optional sub-account attribute that can be defined by a particular organization and retrieved from the OLE via decision support queries.

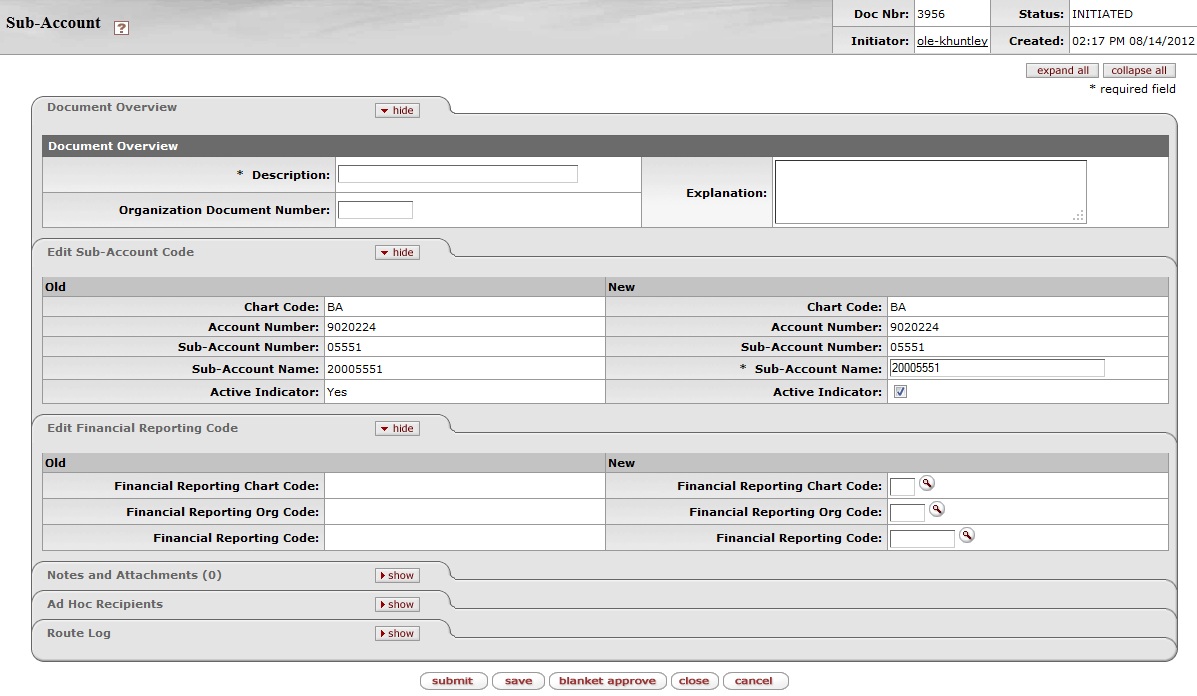

The Sub-Account document includes the Edit Sub-Account Code, and Edit Financial Reporting Code tabs.

|

If you are not establishing a Cost Share sub-account or using the Financial Reporting Code, the Edit Sub-Account Code and the Document Overview tabs are the only required tabs on the document.

|

Edit Sub-Account Code tab definition

|

Title |

Description |

|

Chart Code |

Required. Enter the chart code

associated with the account associated with the sub-account,

or search for it from the UserID lookup |

|

Account Number |

Required. Enter the account number on

which you want to create the sub-account or search for it

from the Account lookup |

|

Sub-Account Number |

Required. Enter the code to define the sub-account. This is the code to be entered in the sub-account field of the Accounting Lines tab of financial documents. |

|

Sub-Account Name |

Required. Enter the long descriptive name. This name appears on the Accounting Lines tab in financial documents as well as in searches and reports. |

|

Active Indicator |

Optional. Select the check box if the sub-account is active. Clear the check box if it is inactive. |

This Financial Reporting Code tab is optional but can be used to associate this sub-account with a Financial Reporting Code. The associated reporting code could then be retrieved via decision support tools.

|

Edit Financial Reporting Code tab definition

|

Title |

Description |

|

Financial Reporting Chart Code |

Optional. Enter the chart code

associated with the organization that owns the assigned

financial reporting code, or search for it from the

Chart lookup |

|

Financial Reporting Org Code |

Optional. Enter the code for the

organization that owns the assigned financial reporting

code, or search for it from the Org

Code lookup |

|

Financial Reporting Code |

Optional. Enter the reporting code

assigned to the Sub-Account, or search for it from the

Financial Reporting Code

lookup |

Takes on most of the attributes of the account to which it reports – fiscal officer, account supervisor; fund group and function code

If sub-account type code is 'CS,' then the fields Cost Sharing Chart of Accounts Code and Cost Sharing Account Number in the Edit CG Cost Sharing tab are required.

If sub-account type code is 'EX' and the Account associated with the Sub-Account is a Contracts and Grants account, then all fields in the Edit CG ICR tab are required.

If any field in the Financial Reporting Code tab is completed, all fields become required.