>

>  >

>  >

>  >

>

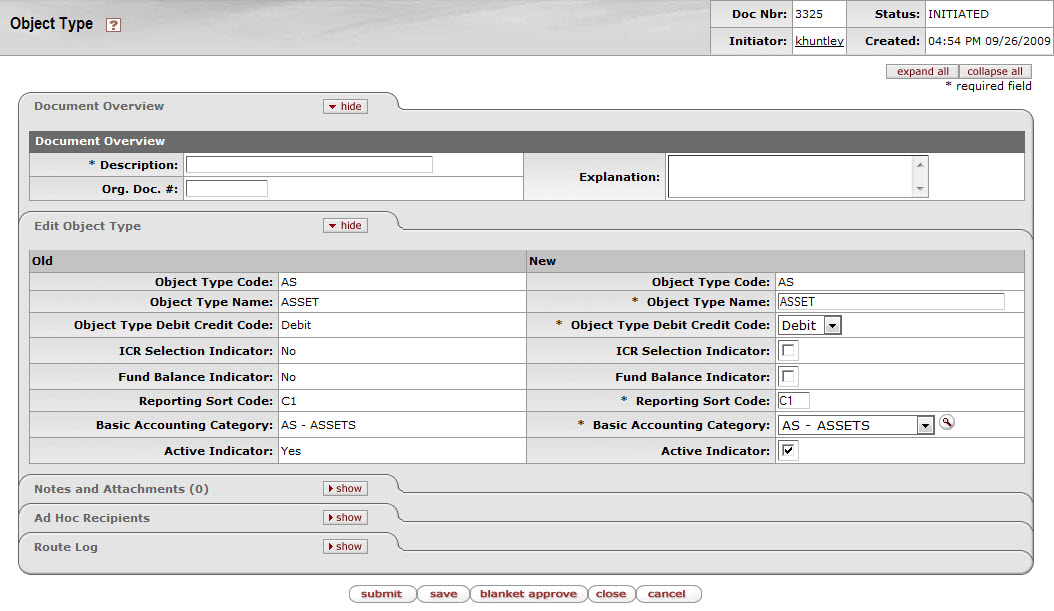

The Object Type document defines the general use of an object code; such as income, asset, expense, or liability.

Tip

When you are configuring the object types, it is important to cross-reference the Object Type table, the System Options table and the OBJECT_TYPES parameters in the Parameter table.

|

The Object Type document includes the Edit Object Type tab. The system automatically enters data into both the Old and New sections. Selected data fields are available for editing.

Edit Object Type tab definition

|

Title |

Description |

|

Object Type Code |

The code assigned to a particular object type. |

|

Object Type Name |

Required. A descriptive label for this object type code. |

|

Object Type Debit Credit Code |

Required. The default accounting balance type of debit or credit for the object code that is retrieved from the list. |

|

ICR Selection Indicator |

The box is checked when the transactions with the object type are eligible for automated indirect cost calculation. |

|

Fund Balance Indicator |

The box is checked when the object type code is used in the fund balance. |

|

Reporting Sort Code |

Required. The code that determines the default sort sequence of object types on certain reports. |

|

Basic Accounting Category Code |

Required. The basic accounting category

code that groups object type codes for use in reporting and

business processes throughout the system. Existing basic

accounting category codes may be retrieved from the list or the

lookup |

|

Active Indicator |

Indicates whether this object type code is active or inactive. Remove the check mark to deactivate this code. |