>

> >

> >

> >

>

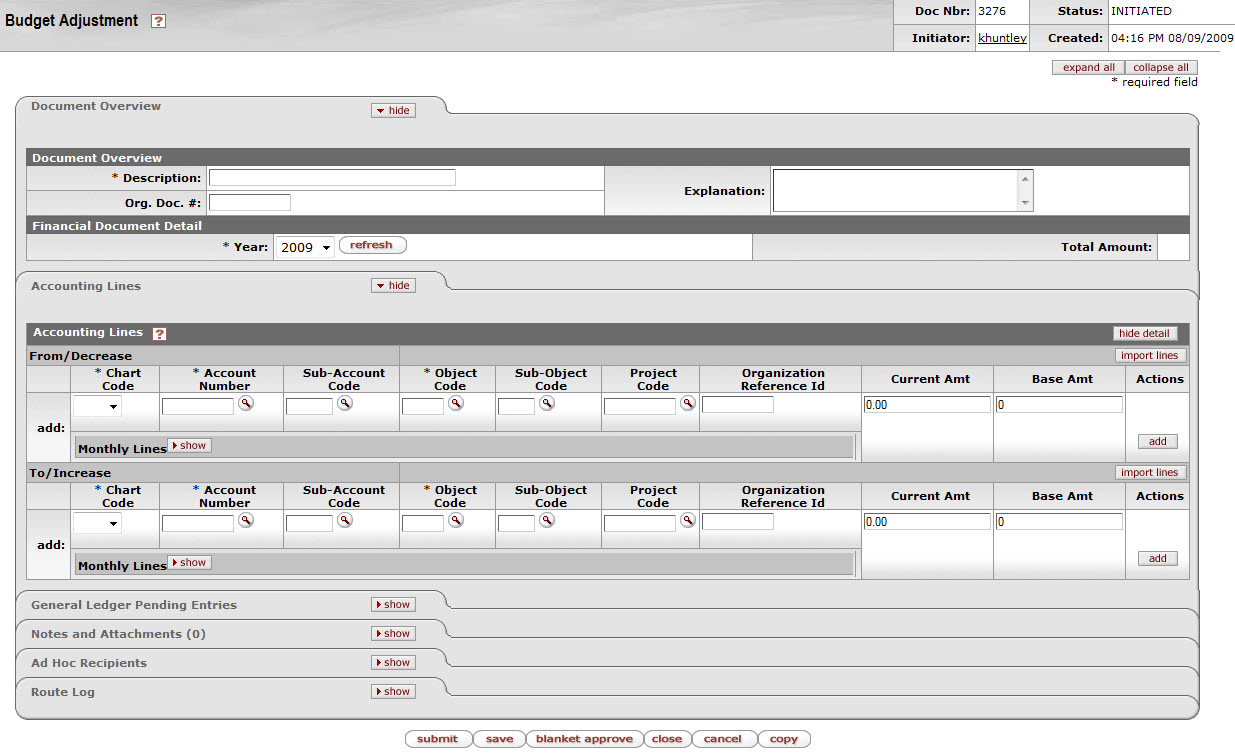

The Budget Adjustment (BA) document is used to record income and expense transactions not processed through other e-docs, against an existing budget. It can be used to modify a base budget, a current budget or both. It is a financial planning tool that allows an organization to adjust the current and base budget figures for a given account as circumstances may change throughout the fiscal year. It may be used to create a budget for a new account established after the beginning of a new fiscal year.

In OLE, a BA document is normally used to:

establish budget lines in new accounts created after the fiscal year begins

make long-term adjustments to the base budget

reallocate current budget as necessary throughout the fiscal year

transfer funds from one general fund account to another

The document allows for the establishment of monthly budgeted amounts for users that wish to maintain budget information at this level.

Note

Budget Adjustments continue to be reviewed for OLE use.

The BA document only has the standard financial transaction document tabs and does not have any unique tabs. Two field exceptions are the Year field in the Document Overview tab and the Monthly Lines section in the Accounting Lines tab, which are explained later in this section.

Note

For more information about the standard tabs, see Standard Tabs on the Guide to OLE Basic Functionality and Key Concepts.

|

The Document Overview tab includes one unique field called Year.

BA Document Overview tab definition

|

Title |

Description | |

|

Year |

Required. Select the fiscal year this adjustment should apply to from the Fiscal Year list. Most budget adjustments are made to the current fiscal year but in some cases you may be able to choose a fiscal year that has not yet begun. | |

If you change the fiscal year, click  to make sure that all the fields on the document are

available for that fiscal year. For example, you might not be able to do base

budget changes to a particular fiscal year. Clicking refresh assures that the system disables fields that aren't

valid for that year.

to make sure that all the fields on the document are

available for that fiscal year. For example, you might not be able to do base

budget changes to a particular fiscal year. Clicking refresh assures that the system disables fields that aren't

valid for that year.

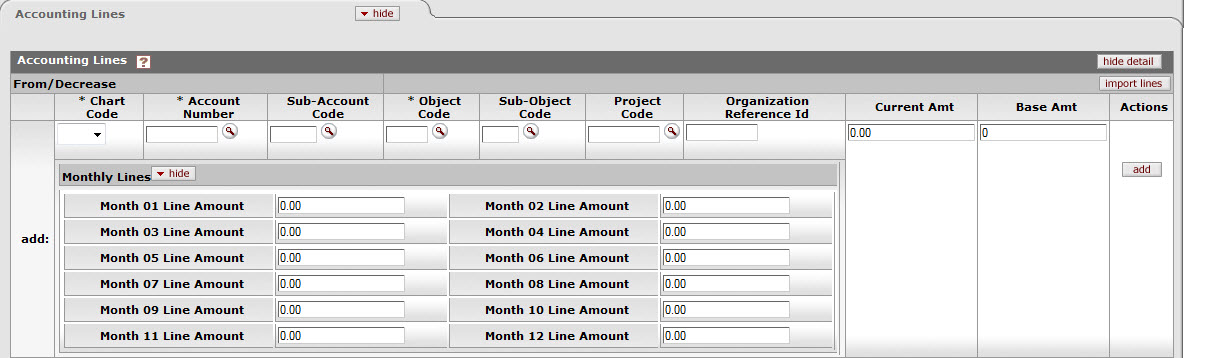

The Accounting Lines tab in the BA document is also different from the other financial transaction documents in that it has the Monthly Lines section that can be expanded by clicking show.

|

To distribute an accounting lines current budget amount into

monthly periods, click  on the Monthly Lines

section.

on the Monthly Lines

section.

This opens a series of twelve monthly periods where you can specify how much of the current amount for this account line should be distributed to each month. The total of all monthly distributions must equal the total current amount for this accounting line.

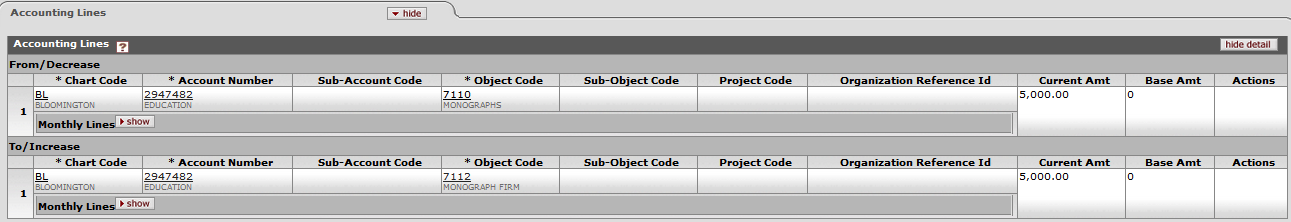

Use of the From/Decrease section automatically decreases the budget associated with the account, sub-account, and object code combination entered. The current budget, base budget, or both may be affected.

Note

Many OLE libraries will not need to use “base” budgets, unless they anticipate needing to track changes between an expected budget and the actual amount allocated. Libraries not needing base budgets can just use the “current” budget to track their allocations.

Use of the To/Increase section automatically increases the budget associated with the account, sub-account, and object code combination entered. The current budget, base budget, or both may be affected.

Note

The From/Decrease and To/Increase sections do not contain totals. Increases and decreases must balance in the document with relation to object code types in order to route the document. This rule applies to the From and To sections affecting the current changed amount(s) and the From and To sections affecting the base changed amount(s).

|

Tip

Try This Budget Setup:

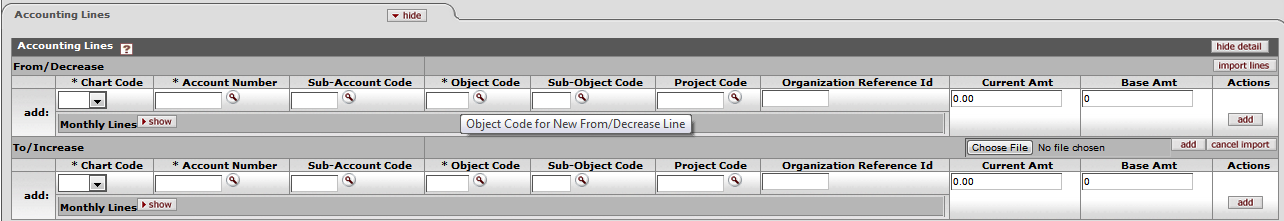

Instead of typing in many accounting detail lines, users can use the BA spreadsheet template via the “Import Lines” option.

Simply fill in all accounting lines with required Chart, Account, Object, and Amounts

Import into the BA (or Transfer) documents in lieu of manual typing.

BA-YEBA Import template

Click

or

or  .

.Review the General Ledger Pending Entries tab.

Review the Route Log tab.

The document is routed to the fiscal officer for each account used in the Accounting Lines. The Route Status shows 'ENROUTE'.

Appropriate fiscal officers and organization reviewers approve the document.

If a Budget Adjustment involves two or more accounts with different Income Stream Accounts, OLE can be configured to create an automated Transfer of Funds transaction to properly adjust cash between those Income Stream accounts. This Transfer of Funds is generated by OLE after the Budget Adjustment is approved and does not route for approval itself.

(Note: many OLE libraries may choose not to track income streams, in which case this feature will never be invoked.)

Only accounts that have the recording level attribute of 'Budget' accept budget adjustment transactions. The budget adjustment document cannot be used on a cash control (non-budgeted) account.

Note

If you only plan to track budgeted funds in OLE, you can set up all your accounts with a recording level attribute of 'Budget'.

Negative amounts are not allowed except when using the Error Correction option.

Note

For information about the error correction, see Correcting Errors After Approval on the Guide to OLE Basic Functionality and Key Concepts.

Increases and decreases must balance in the document with relation to object code types. Increases in income may be balanced by decreases in other income lines or by increases in expenditures. Decreases in income may be balanced by increases in other income lines or by decreases in expenditures. Similar logic applies to changes in expenditures

If Base Adjustments have not been enabled for the selected Fiscal Year on the document then base changes are not allowed.

The fund group and sub-fund group attributes on an account contain an attribute (Budget Adjustment Restriction Code – BARC) for determining how budget adjustments within that group can be made. These attributes limit the mixing of accounts on the same BA documents.

BARC values for fund group are: C (Chart), O (Organization), A (Account), or F (Fund).

BARC values for sub-fund group are: C (Chart), O (Organization), A (Account), S (Sub-Fund), or N (None).

If the BARC value of the sub-fund group is none, the BARC value of the sub-fund group’s parent fund group applies to the account.

The budget adjustment applies the following rules using these values:

If an account on the BA has an effective BARC of Account, then no other account can be used on that Budget Adjustment document, i.e. all adjustments (increases/decreases) must be to the same account.

If an account on the BA has an effective BARC of Organization, then the only other accounts on that Budget Adjustment document must belong to the same Organization, i.e. allowing adjustments among accounts in the same organization.

If an account on the BA has an effective BARC of Chart, then the only other accounts on that Budget Adjustment document must belong to the same Chart, i.e. allowing adjustments across accounts belonging to different Organizations but within the same Chart.

If an account on the BA has an effective BARC of Sub-Fund, then the only accounts on that Budget Adjustment document must belong to the same Sub-Fund Group, i.e. allowing adjustments across accounts belonging to different Organizations and Charts but with the same Sub-Fund Group Code.

If an account on the BA has an effective BARC of Fund, then the only accounts on that Budget Adjustment document must belong to the same Fund Group, i.e. allowing adjustments across accounts belonging to different Organizations and Charts and Sub-Fund Groups but with the same Fund Group Code.

The use of certain balance sheet object codes and certain object sub-types may be prohibited according to your institution's business rules.

The BA document is approved as final by the initiator if the following conditions are met:

The document only adjusts a single account

The document only adjusts current budget amount

The Initiator is the fiscal officer for the account

The total decrease amount is not greater than the current budget balance for the object code being decreased

If previous conditions are not met, the document continues with standard financial document routing, based on the account numbers used on the document as follows:

The fiscal officer for each account must approve.

Organization review routing occurs for the organization that owns each account.

Sub-fund routing occurs based on the sub-fund of each account.

The document status becomes 'FINAL' when the required approvals are obtained and the transaction is posted to the G/L during the next G/L batch process.

Select Create Budget Adjustment from the Funds section of the Select & Acquire menu.

A blank BA document with a new document ID appears.

Complete the standard tabs.

Note

For information about the standard tabs such as Document Overview, Notes and Attachments, Ad Hoc Recipients, Route Log, and Accounting Lines tabs, see Standard Tabs on the Guide to OLE Basic Functionality and Key Concepts.

Click

.

.The document is routed to the fiscal officers of the accounts as well as any approvers in the Organizational Review hierarchy.

Review the General Ledger Pending Entries tab.

Review the Route Log tab.

Note

For information about the Route Log tab, see Route Log on the Guide to OLE Basic Functionality and Key Concepts.

Appropriate fiscal officers and organization reviewers approve the document.

Note

For more information about how to approve a document, see Workflow Action Buttons on the Guide to OLE Basic Functionality and Key Concepts.