>

>  >

>  >

>  >

>

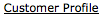

The Customer Profile document allows you to enter and maintain basic information about customers who are permitted to submit disbursement information to the PDP.

Each file loaded into the PDP must be associated with a valid customer in the Customer Profile table. The Customer Profile includes various information about the customer, including contact information, text that is to appear in the customer's ACH email messages to payees, and default accounting information. It also includes bank information that specifies the banks to be used for ACH and check disbursements from this customer. Lastly, it indicates the campus where this customer's payments are to be processed.

Only users with the OLE-SYS Operations role may create Customer Profile documents. These documents do not route for approval.

|

The Customer Profile document includes the Edit Customer Profile, Customer Check/ACH, Customer Processing, and Edit Customer Bank tabs. The system automatically enters data into both the Old and New sections. Selected data fields are available for editing.

This tab contains basic identifying and contact information for this PDP customer. It also indicates the campus where this customer's payments are to be processed.

|

Edit Customer Profile tab definition

|

Title |

Description |

|

Customer Profile ID |

Display only. A system-generated unique number to identify this customer. |

|

Chart |

Required. The chart code associated

with this customer. Existing charts may be retrieved from

the lookup |

|

Unit |

Required. A unit code to identify this customer. Unit codes are free-form and up to four characters in length. |

|

Sub-Unit |

Required. A sub-unit code to identify this customer. Like unit codes, sub-unit codes are free-form and up to four characters in length. |

|

Description |

Required. A text description of this PDP customer. |

|

Campus Process Location |

Required. The campus code identifying

the campus on which this customer's payments are normally to

be formatted. Existing campus locations may be retrieved

from the lookup |

|

Campus Process Email Address |

Required. The primary e-mail address for this PDP customer. |

|

File Threshold Amount |

Required. A dollar amount limit for payment file batches from this customer. Payment files over this amount will still load into the PDP but will generate a warning e-mail indicating that the threshold was exceeded. |

|

File Threshold E-mail Address |

Required. The e-mail address to which warning messages should be sent when a customer's batch of payments exceeds the file threshold amount. |

|

Payment Threshold Amount |

Required. A dollar amount limit for individual payments from this customer. Payments over this amount will still load into the PDP but will generate a warning e-mail indicating the threshold was exceeded. |

|

Payment Threshold E-mail Address |

Required. The e-mail address to which warning messages are to be sent when a payment exceeds the payment threshold amount. |

|

Primary Contact Name |

Required. The name of the primary contact person for this PDP customer. |

|

Address 1-4 |

The mailing address for this PDP customer. Up to four lines may be entered. Only Address Line 1 is required. |

|

City |

Required. The city for this PDP customer's address. |

|

State |

Required. The state for this PDP

customer's address. Existing state abbreviation codes may be

retrieved from the list or from the lookup |

|

Zip |

The zip code for this PDP customer's

address. Existing postal zip codes may be retrieved from the

lookup |

|

Country |

The country for this PDP customer's.

Existing countries may be retrieved from the list or from

the lookup |

|

Active Indicator |

Indicates whether this customer profile ID is active or inactive. Remove the check mark to deactivate the ID. |

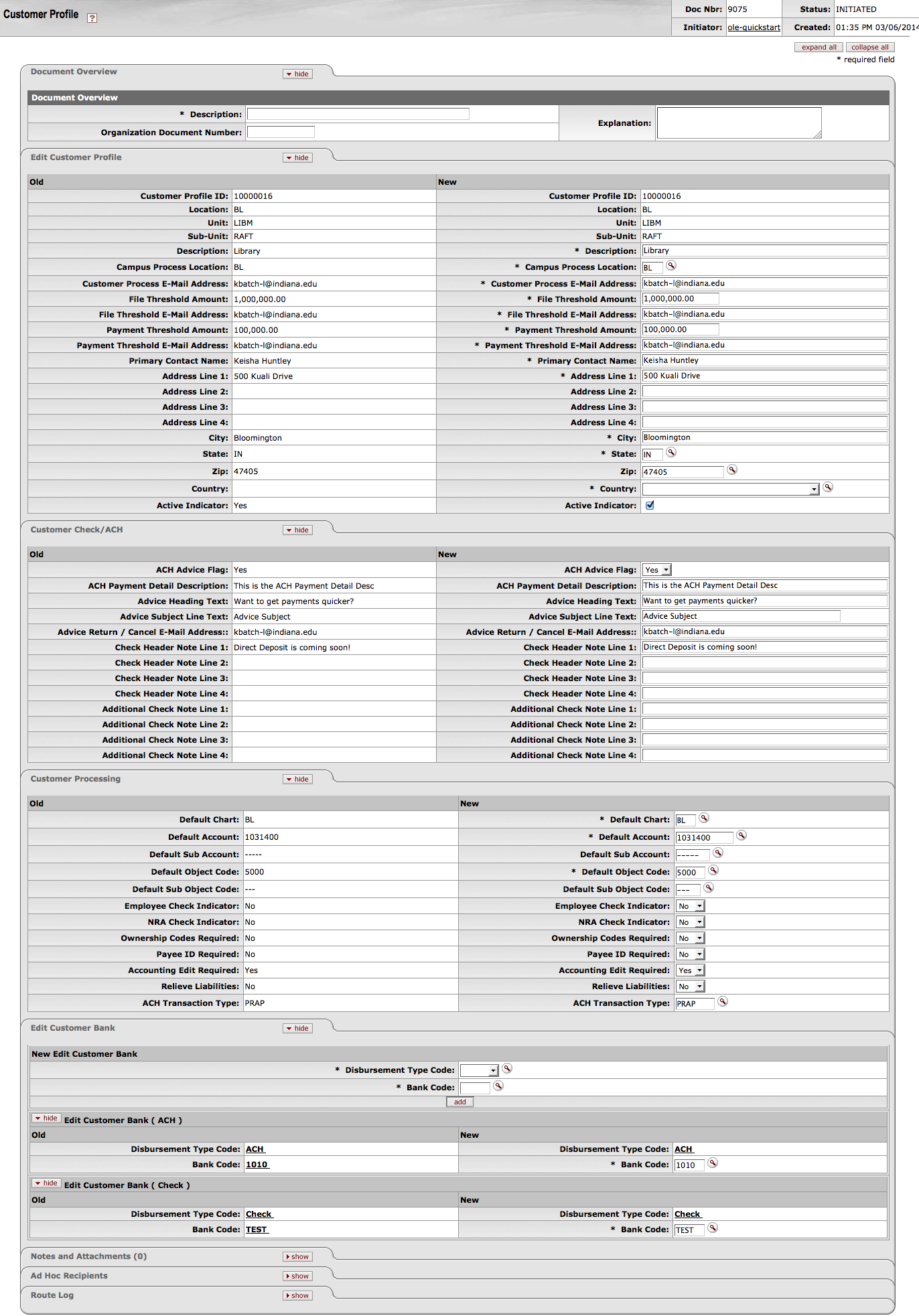

PDP customers may choose to specify text that will be displayed in ACH emails to payees or as notes on checks. This section defines that text.

|

Customer Check/ACH tab definition

|

Title |

Description |

|

ACH Advice Flag |

Indicates that an e-mail pay advice will be generated for ACH payments from this customer. Selecting "No" indicates that an e-mail advice will not be generated. |

|

ACH Payment Detail Description |

Optional. The text that to be displayed as the detailed payment description for e-mail advices related to ACH deposits from this customer. |

|

Advice Heading Text |

Optional. The text to be displayed as the heading for e-mail advices related to ACH deposits from this customer. |

|

Advice Subject Line |

Optional. The text to be displayed as the subject line for e-mail advices related to ACH deposits from this customer. |

|

Advice Return / Cancel E-mail Address |

Optional. The e-mail address to be notified if an ACH advice e-mail is returned or encounters an error. |

|

Check Header Note Line 1-4 |

Optional. The text lines to be displayed in the check header for disbursements from this PDP customer. |

|

Additional Check Note Line 1-4 |

Optional. The text lines to be displayed in the Notes section of check disbursements from this PDP customer. |

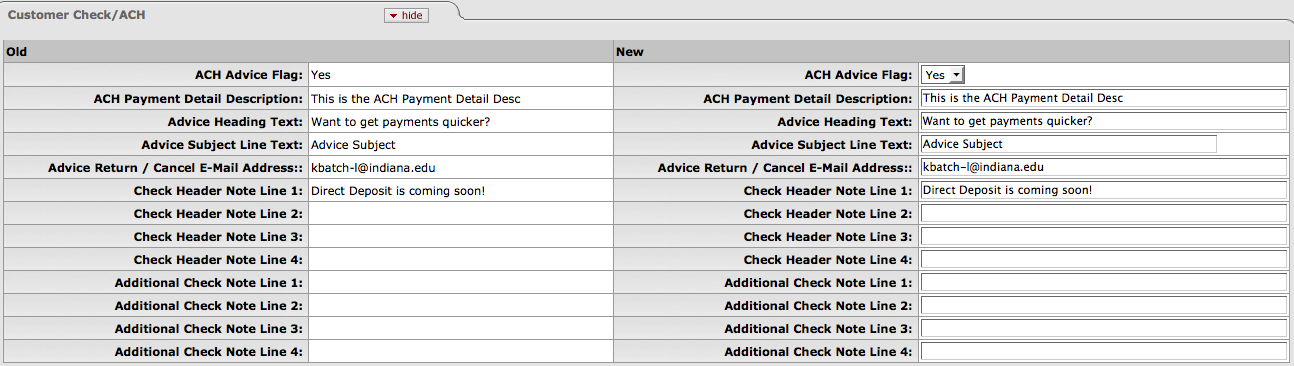

This section defines the default accounting string for payments from a PDP customer. It also allows you to customize some PDP behaviors (such as the generation of e-mails) based on the wants of the customer.

|

Customer Processing tab definition

|

Title |

Description |

|

Default Chart |

Required. The chart code of the account

that is to be substituted if this customer's file supplies

an invalid accounting string. Existing chart codes may be

retrieved from the lookup |

|

Default Account |

Required. The account number that is to

be substituted if this customer's file supplies an invalid

accounting string. Existing accounts may be retrieved from

the lookup |

|

Default Sub Account |

The sub-account number that is to be

substituted if this customer's file supplies an invalid

accounting string. To indicate no sub account, five dashes

can be entered in this field. Existing sub accounts may be

retrieved from the lookup |

|

Default Object Code |

Required. The object code that is to be

substituted if this customer's file supplies an invalid

accounting string. Existing object codes may be retrieved

from the lookup |

|

Default Sub Object Code |

The sub-object code that that is to be

substituted if this customer's file supplies an invalid

accounting string. To indicate no sub-object, three dashes

can be entered in this field. Existing sub object codes may

be retrieved from the lookup |

|

Employee Check Indicator |

Box checked indicates that the customer is an employee. |

|

NRA Check Indicator |

Box checked indicates that the customer is a non-resident alien. |

|

Ownership Codes Required |

Box checked requires files from this customer to include ownership codes for each payment. |

|

Payee ID Required |

Box checked requires that payments from this customer include a payee ID number. |

|

Accounting Edit Required |

Box checked requires that the accounting string for payments from this customer is validated against the Chart of Accounts. |

|

Relieve Liabilities |

Box checked indicates that payments made by the PDP for this customer will debit a liability instead of debiting an expense object code. |

|

ACH Transaction Type |

Optional. The PDP supports ACH payees

with multiple sets of banking information (for example,

payees who want payments from certain customers deposited to

different bank accounts). This code is used to identify the

appropriate ACH record for payments from this customer.

Existing ACH transaction types may be retrieved from the

lookup |

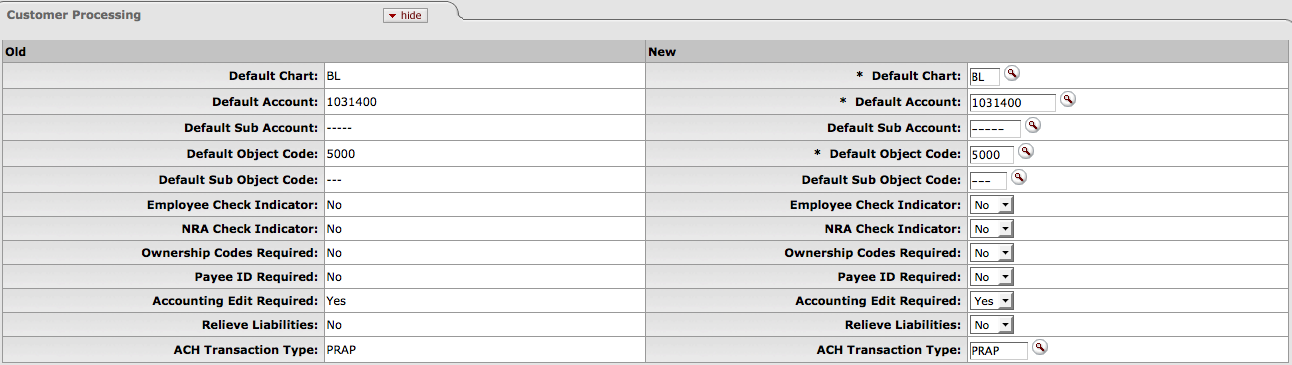

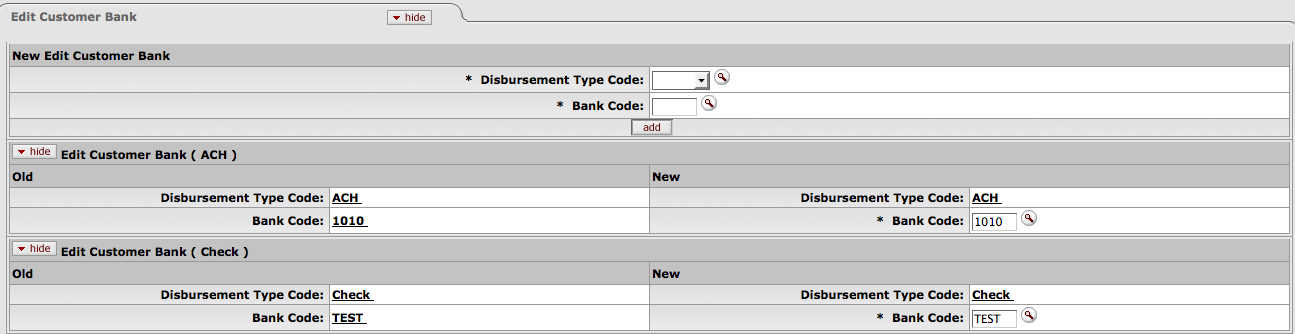

This tab defines the banks that a PDP customer's disbursements are to be made from. Different banks can be defined for different payment types (checks vs. ACH).

|

Edit Transaction Type tab definition

|

Title |

Description |

|

Disbursement Type Code |

The disbursement type code (ACH or

Check) for this bank can be selected from the drop down list

or searched for from the Disbursement Type Code lookup |

|

Bank Code |

The bank code for this disbursement

type. Enter the appropriate code or search for and select a

value using the Bank lookup |

|

Add |

Click the add button to add a new combination of disbursement type and bank code to this customer. Note that a Customer Profile may have only one bank per disbursement type. |

The Customer Profile is required to run the purchasingPreDisbursementExtractJob that will populate the evoucher related tables in the database otherwise an exception will occur.

Additionally for the job to run, the OLE-PDP parameter FROM_EMAIL_ADDRESS is required to have the same value as the Customer Profile's Customer Process E-mail Address.

See OLE-6428