>

>  >

>  >

>  >

>  >

>

Even though a library's acquisition process does not require that the library actually do their own banking, at least one bank record is required to process invoices. Banks are also used to identify institutions to which deposits are made on Advance Deposit and Cash Management documents. In the PDP, they are used to identify institutions from which disbursements are made. This functionality was an inheritance from KFS and requires future refactoring.

The Bank document allows you to view and edit bank information currently in OLE, including the bank's routing number and account number. Using this screen, you may also add new banks to the system.

When the Flexible Banking Enhancement is in use, additional document types may require users to identify a bank.

Only users with the OLE-SYS Manager role may create Bank maintenance documents. These documents do not route for approval.

|

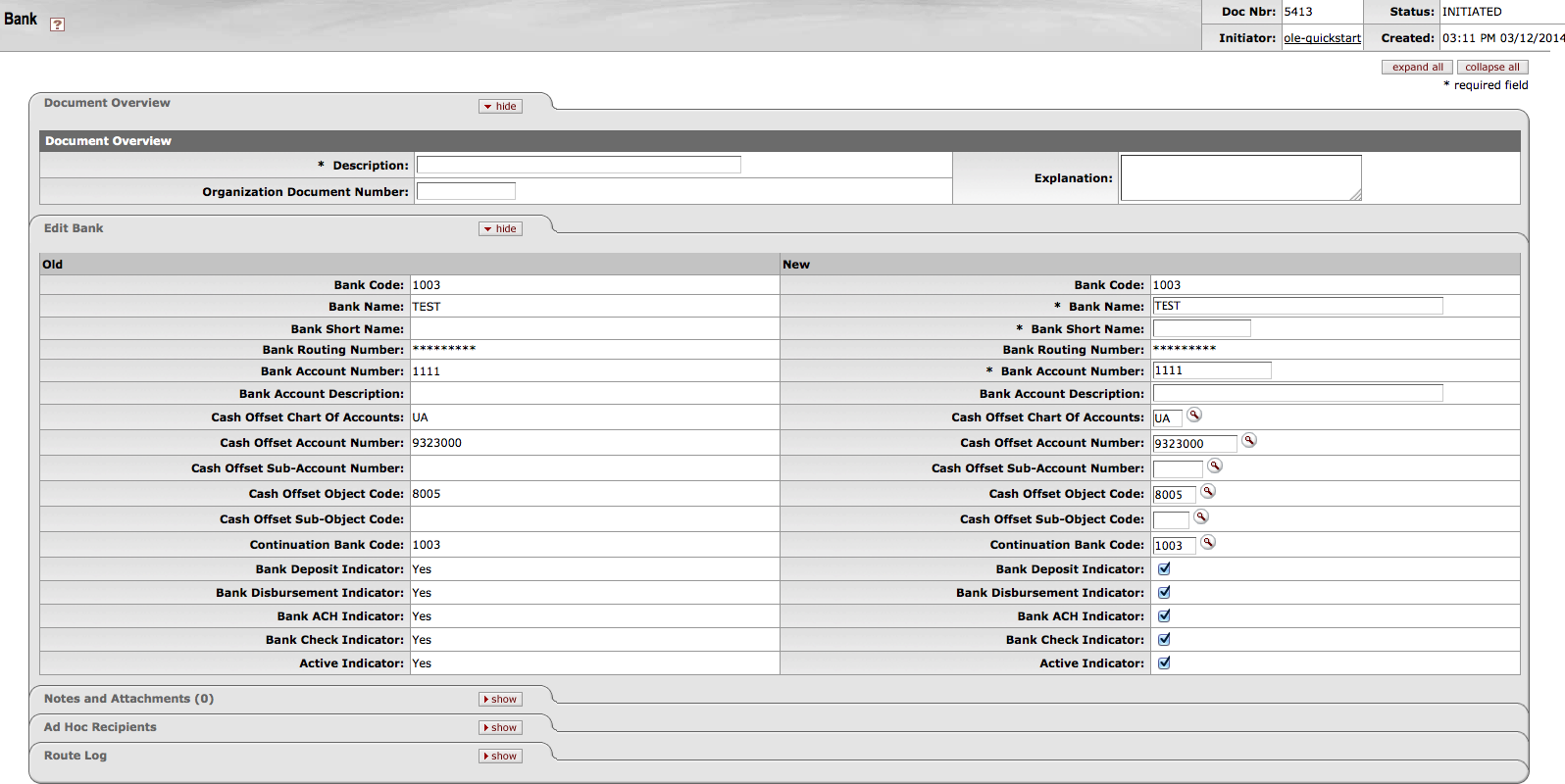

The Bank document includes the Edit Bank tab. The system automatically enters data into both the Old and New sections in this tab. Selected data fields are available for editing.

Edit Bank tab definition

|

Title |

Description |

|

Bank Code |

A unique ID number that identifies this bank in OLE. |

|

Bank Name |

Required. The name of the bank associated with this code. |

|

Bank Short Name |

Required. An abbreviated name for the bank (up to 12 characters allowed). |

|

Bank Routing Number |

The routing number associated with this bank. |

|

Bank Account Number |

Required. The bank account number from which disbursements are to be drawn or deposits made. |

|

Bank Account Description |

A text description for this bank account. |

|

Cash Offset Chart of Accounts |

Optional. If using the Flexible Banking

Enhancement, this is the Chart of Accounts code associated with

the account to which cash offsets should post when OLE

transactions are associated with this bank. Existing chart codes

may be retrieved from the lookup |

|

Cash Offset Account Number |

Optional. If using the Flexible Banking

Enhancement, this is the account number to which cash offsets

should post when transactions are associated with this bank.

Existing accounts may be retrieved from the lookup |

|

Cash Offset Sub-Account Number |

Optional. If using the Flexible Banking

Enhancement, this is the number of the sub-account to which cash

offsets should post when transactions are associated with this

bank. Existing sub-accounts may be retrieved from the lookup |

|

Cash Offset Object Code |

Optional. If using the Flexible Banking

Enhancement, this is the object code that should be used for

cash offsets that post when transactions are associated with

this bank. Existing object codes may be retrieved from the

lookup |

|

Cash Offset Sub-Object Code |

Optional. If using the Flexible Banking

Enhancement, this is the sub-object code that should be used for

cash offsets that post when transactions are associated with

this bank. Existing sub-object codes may be retrieved from the

lookup |

|

Continuation Bank Code |

Optional. A bank code to be used in place

of an inactive bank code. Existing bank codes may be retrieved

from the lookup If OLE attempts to reference a Bank record that has an inactive bank code, the system uses bank information associated with the specified continuation bank code instead. |

|

Bank Deposit Indicator |

Checked box indicates that this bank will be used for deposits. NoteNote that a bank may be used for both deposits and disbursements. |

|

Bank Disbursement Indicator |

Checked box indicates that this bank will be used for disbursements. NoteNote that a bank can be used for both deposits and disbursements. |

|

Bank ACH Indicator |

Checked box indicates that this bank will be used for ACH disbursements in the PDP. NoteNote that a bank can be used for both ACH deposits and checks. |

|

Bank Check Indicator |

Checked box indicates that this bank will be used for check disbursements in the PDP. NoteNote that a bank can be used for both ACH deposits and checks. |

|

Active Indicator |

Indicates whether this bank code is active or inactive. Remove the check mark to deactivate. |

There’s a parameter called “Default_Bank_By_Document_Type” which sets a default Bank for each document type. Make sure the bank values you have in this parameter actually exist in the FP_BANK_T table (the bank maintenance document). A default bank is provided with the bootstrap data. If you create a new default bank, the parameter values must match it.

The value for the Default_Bank_By_Document_Type parameter in OLE's demo system is OLE_DV=TEST;OLE_ND=TEST;OLE_AD=TEST;OLE_CMD=TEST;OLE_PREQ=TEST;OLE_PRQS=TEST;OLE_CM=TEST;OLE_CTRL=TEST;OLE_CCR=TEST. The syntax for the value is “doctype=bank;” These values will not appear on the Invoice document, since its Bank Code field is an input box, but they do work within the code. Without the bank and the Default_Bank_By_Document_Type parameter correctly implemented, you will receive the message "Bank Code is a required field" when you create an Invoice.